Most venture capitalists avoid infectious disease because the sickest patients live in countries that can't pay for expensive medicine—and because a one-time treatment can charge only a fraction of what a lifetime chronic drug can. Then again, one-time treatments for patients aged 18-30 in the developing world can be 10× to 100× cheaper to study than the Big Pharma playbook would have you believe.

I'm joined this week by Charlie Petty, a managing director at the Global Health Investment Corporation—a venture fund that looks for profitable investments in companies developing treatments for the developing world. Their thesis is that you can make money solving problems for huge markets of people who have relatively little money, if you're creative about how markets work.

We talk about what makes his job harder (and easier) than conventional biotech VC, which clinical trials cost an order of magnitude (or more!) less than you'd expect, selling to national and international drug stockpiles, and the looming rise of a “less unipolar” biotech world.

Quotes

“Most people are in this business to improve the world.” (28:55)

Charlie Petty:

Oftentimes, we’re one of the smaller institutional checks—but we get substantial face time with company [management] and spend considerable time with them, maybe we get a board seat. That’s largely because—as I said earlier—most people are in this business to improve the world.

There are exceptions, but if you’re the CEO of a scrappy biotech company, you could be doing many different things—so most of the people we interact with are pretty great, and are doing this for noble reasons.

Ross:

But you’re one of the few capital providers who is actually speaking to that motivation of why the founders are there in the first place.

Charlie Petty:

Yeah, well, there are several reasons that could be. Part of our identity came from, just, willpower exerted 10-15 years ago, by the people at the Gates Foundation and JPMorgan who formed GHIC—mostly driven by big personalities like Bill [Gates]. Sometimes that’s what it takes to get things done in the world.

And another one is: we’ve chosen a strategy around what we think will actually work. I don’t think that this would work well—speaking empirically—in a domain where you don’t have a robust adjacent commercial engine, which in this case is pharmaceutical development.

Elsewhere in healthcare, there have been a bunch of funds launched around digital health, MedTech, patient access, or physical infrastructure that have struggled; in our area, we benefit from this engine of intellectual property generation in the US and other biotech ecosystems.

“Sometimes we want clinical trial costs to be lower, but sometimes…” (38:44)

Charlie Petty:

A company that’s operating a Phase II trial is also burning tens of millions of dollars a year in overhead—

Ross:

—wait, where’s that money going?

Charlie Petty:

Well, it’s less than 100 people at the company, but you have a whole Regulatory Affairs team, you have a [drug manufacturing] team, you’ve started a clinical research team—

The basic model for a biotech these days is, you can be fairly outsourced and remote early on—using Clinical Research Organizations and also [Contract Development and Manufacturing Organizations] for your manufacturing—but as you go on, you do have to bring more of that in-house. If you’re developing a novel drug, you just have to have an internal team of people who understand how the drug is made. So then we’re talking about twenty PhDs in San Francisco or Boston, and that’s very expensive.

Then you need regulatory affairs, medical affairs, people just processing the data from a clinical trial even after you get it from the CRO—that’s a huge task; regulatory affairs is more art than science, and it requires the right person for that role; leadership, a CFO and other staff—it adds up quickly.

Ross:

So you’re burning tens of millions of dollars a year—

Charlie Petty:

—just on staff and offices. These are not extravagant operations, but it adds up.

So time is of the essence, because in biotech VC, you fund in a single tranche to a milestone, and then you fund again, and so you’re constantly in this race [to reach the next milestone before the money runs out]. Sometimes we want clinical trial costs to be lower, but sometimes we choose for them to be higher so that we can go faster—because there are other costs accruing that are not directly related to the trial, and that would sink the company before the trial would be completed.

You're constantly balancing quality, size, speed, and investor appetite. If you were to come to me and say “we found a way to make a vaccine trial where patients are going to cost $1,000—it’s going to take 15 years to recruit them, but you’re going to save 90% on clinical trial recruitment”, that just doesn’t work.

“There are so many levers to pull on to reduce costs…” (48:02)

Ross:

But you do see public-health drug-development programs that might cost tens of millions of dollars rather than a billion?

Charlie Petty:

Totally. The billion-dollar figure refers to a blockbuster program for US and European populations, but for public-health drugs or vaccines, trials are often run in emerging markets where the cost per patient can be an order of magnitude lower. You’re often in areas where the disease you’re targeting is endemic—making it easier to find patients—or where attack rates of disease are higher, or where the population is untreated, vaccine-naïve, or the existing standard of care is just lower.

There's an interesting question—in biopharma in general—whether more trials should be done outside the US, but for global health products, a lot is done internationally because you have to.

But there’s other interesting things you can do to save money—Australia has an amazing R&D tax credit program—you basically get a 40% credit from the government for doing research and development there—so many of our companies have subsidiaries there, and Australia now has this amazing R&D ecosystem for public health.

There are so many levers to pull on to reduce costs—on the manufacturing side, on the clinical trial side—and we’re often talking to our companies about just these things: How can we save money and make the cost of capital low enough to attract capital from other investors to bring the projects forward?

Timestamps

1:03 - Introduction

1:27 - Why is infectious disease commercially difficult?

5:26 - Where do our healthcare dollars go?

7:49 - GHIC: the Global Health Investment Corporation

10:07 - Alternative business model #1: Selling to pharmaceutical stockpiles

12:59 - Alternative business model #2: Priority Review Vouchers

18:06 - Alternative business model #3: Making your own investment opportunities

21:10 - Portfolio composition: New tech vs known platforms

23:00 - Evaluating (counterfactual) impact

26:26 - Working with company management

28:55 - “Most people are in this business to improve the world”

31:09 - More expensive and slower: “We’re in it with everyone else”

38:44 - “Burning tens of millions of dollars a year in overhead”

42:06 - Can trials cost less?

48:02 - Clinical trials outside the US

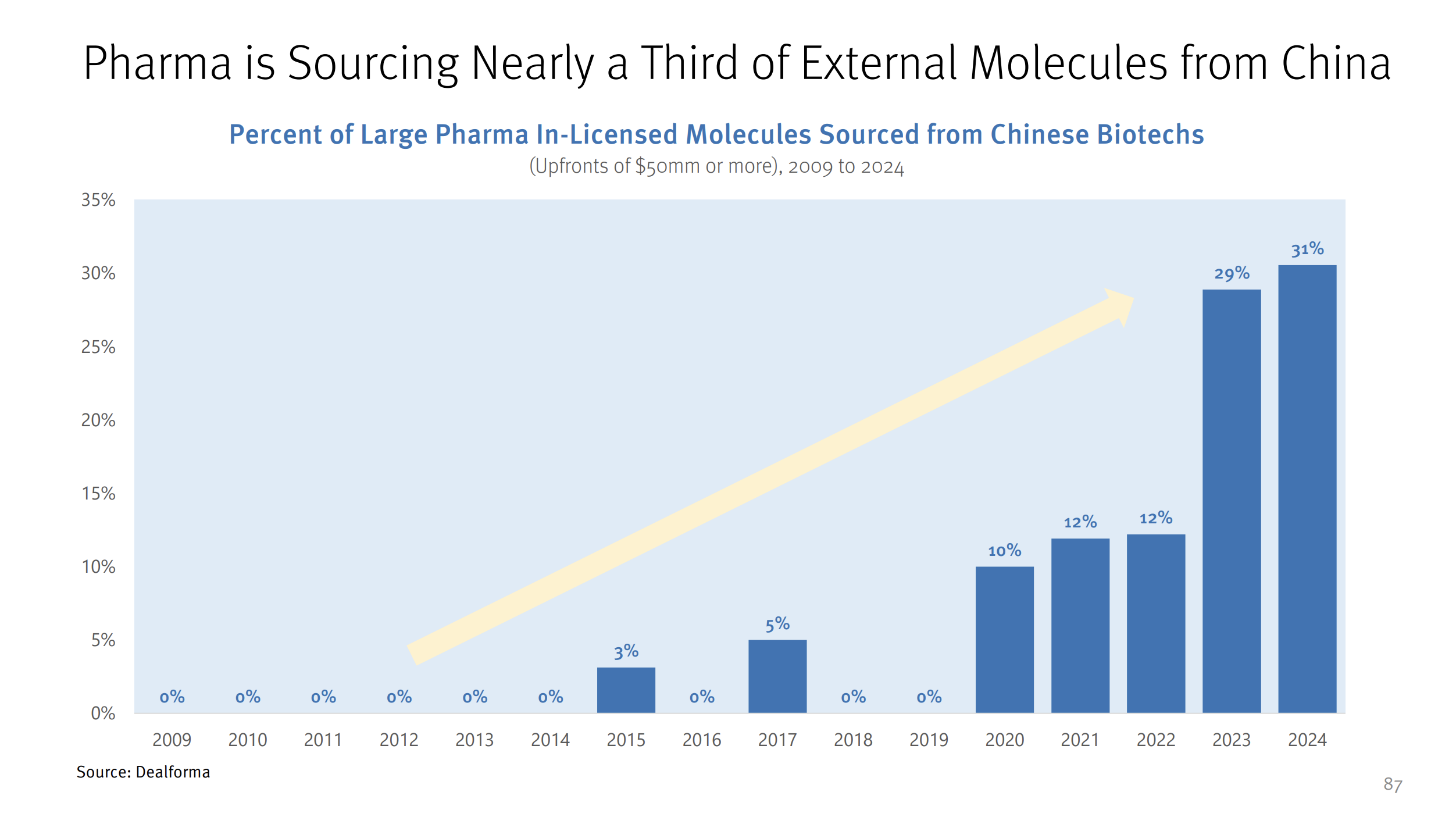

54:13 - The rise of Chinese biopharma

57:41 - Ex-US / ex-China drug development

1:01:09 - Who should regulate drugs for the world?

1:05:30 - The future of global public health

Transcript

Introduction (1:03)

Ross Rheingans-Yoo:

Welcome back to Development & Research, where we talk about doing things differently in the world of clinical trials and drug development. I’m here with Charlie Petty, who is a managing director at an investment firm that focuses on an area that is widely considered more suitable for charity work than investment.

Welcome, Charlie.

Charlie Petty:

Thanks for having me. I’m excited to do this.

Why is infectious disease commercially difficult? (1:27)

Ross:

Let’s get into that oddity from the top—why is infectious disease considered a commercially difficult area, and what is different about your investment thesis?

Charlie Petty:

I think there’s a dozen ways to answer that.

One way of thinking about it is in terms of the end markets: who gets infectious diseases most often? Where is the highest mortality and morbidity? It’s in the developing world, it’s people who cannot pay for medicine and systems without industrialized large-scale healthcare delivery systems like we have in the US and Europe.

The other way of thinking about it is in terms of the emergent nature of the world, which is that when you want to take care of an infectious disease, for the most part, you can cure it by killing the bug. There are exceptions like HIV, where we haven’t figured out how to do that yet. But Hepatitis C is a good example of a single regimen of antivirals that can clear the disease forever.

That’s on the treatment side. On the prevention side, you have vaccines where in some cases, infant and childhood immunizations, it’s one and done, maybe get a booster every 10 years. Flu, COVID, and a couple of other examples may happen annually, but it’s really a one-time experience with the drug.

Ross:

And the economics of that on the commercial side, on a vaccine, these things, between the people who are actually paying, cost $25?

Charlie Petty:

Historically, they’ve been in a very low single-digit to tens-of-dollars range, depending on what market you’re talking about. In emerging markets, it's quite low—when shipping to East Africa, they’re $2-$4. Flu vaccines are in the $20 to $30 range in the US reimbursement world. Flu is a whole weird ball game because we procure some of it ourselves and approve new vaccines annually based on the circulating strain in the Southern Hemisphere. So for the one-and-dones, it’s in that range.

That said, there are next-generation flu vaccines that have more antigens, more dose, or a [new] adjuvant. [Ross: Antigens are molecular shapes that an antibody can stick to; a vaccine will include 1-4 kinds of antigens that appear on a pathogen in order to teach the immune system to recognize them. An adjuvant is an additional ingredient that says “Hey, immune system! Wake up! These antigens are bad news, so you better remember them for later!”, which prompts the body to make memory cells that remember how to make a specific antibody type if it ever sees antigens for it in the future.] Those are used for people with compromised immune systems or older people whose immune systems are less responsive. Those can be in the $60 to $90 range—that’s the start of the “premium” vaccines.

In the past 15 years, we’ve had approvals for premium vaccines that are next-generation vaccines, both from a modality standpoint and for diseases that previously didn’t have first-gen vaccines. Some examples here include Shingrix for shingles and Gardasil for HPV and HPV-associated cancers. A full course of these in the US and Europe is in the hundreds of dollars. Gardasil is a three-dose regimen with a total package in the mid- hundreds of dollars.

It’s exciting for my world that the market is willing to pay for these premium vaccines, especially where the sequelae of the underlying virus are related to chronic conditions or, in the case of HPV, cancers. [Ross: Sequelae are the health effects that persist after you fight off an infection. Other examples that Charlie doesn’t mention: it’s not just HPV linked to cancers, EBV is linked to Multiple Sclerosis, CMV is linked to accelerated aging, and I’ll bet you dollars to sand we’re not even close to done discovering the full range of oncogenic viruses.]

Ross:

Those are things that can get very expensive—

Charlie Petty:

—they get expensive [to society], and so the public-health math makes sense.

As opposed to—it would be hard to say that influenza is a nuisance, because it kills 40,000 people a year, but it’s seen as old school public health, and the norms have been established there that we can make these vaccines very cheaply. Whereas, something that prevents a previously untreatable cancer is an amazing innovation we're willing to pay slightly more for.

Where do our healthcare dollars go? (5:34)

Ross:

It sounds like you’re excited when the market’s willing to bear $80 for a vaccine that’s solving $800 of problem, but none of this holds a candle to what the US spends on its expensive healthcare—chronic disease management, oncology, and age-related conditions—there we’re spending thousands to six figures a year [per patient].

Charlie Petty:

Exactly. In the US, drugs are 10-15% of total spend. From our multi-trillion-dollar healthcare industry, hundreds of billions of dollars go to drugs—everything from vaccines to small-molecule pills to chemotherapy drugs to gene therapies.

The rest of that is going to three big buckets:

- End-of-life care—there’s a ton of that going on in the hospital, with all sorts of drugs.

- Oncology—there are many kinds of oncology drugs, but if you’re talking about chemotherapy and surgeries, these are very long durations of care that add up over time. You could comment on the efficiency of certain kinds of oncology interventions…but even putting that aside, they’re still very expensive.

- And chronic conditions—the antibodies that are used for autoimmune conditions are tens of thousands of dollars per year per patient in perpetuity. And if diagnosed with ulcerative colitis or psoriasis in your mid-thirties, you use these drugs for the rest of your life.

The burden [of costs from expensive lifetime drugs] is enormous and much more than the eye-watering price tags of one-time gene therapies like Zolgensma, which don’t actually make up a huge portion of healthcare or drug spend today.

Ross:

So with that baseline—these are the things that are difficult, the market is not willing to bear high costs even when global mortality is steep, the one-time versus chronic nature—all of this creating commercial headwinds…

Where does GHIC come into this? Where do you see the opportunity in this landscape?

GHIC: the Global Health Investment Corporation (7:56)

Charlie Petty:

We’re a 10-year-old mission-driven investment manager originally formed by the Gates Foundation and JPMorgan to try to figure out if you can have sustainable investing strategies in global public health. It takes a bunch of different flavors for us, but our core strategy is venture.

We do several different things. One is investing in vaccine companies where there’s an attractive target—like Shingrix and Gardasil—and there’s a pipeline of products that could use the same technology platform for [other diseases in] global health.

Ross:

So there's a US market for something like the HPV vaccine, but once that technology is developed, it can be repurposed for diseases that don't have markets that would’ve borne the whole cost of research and development?

Charlie Petty:

HPV is an unusual example because it’s both a blockbuster vaccine [in the US and Europe] and a big global problem; just as a single asset, Gardasil is an important public-health tool. A better example of a platform technology that was first used commercially and later for global public health is mRNA—Moderna wasn’t focused on pandemic vaccines at the outset, but the fact that they spent hundreds of millions developing cancer vaccines and vaccines for latent viral infections provided the world an endowment of technology that could be repurposed for a pandemic.

Once we had legacy vaccines in various areas, it gave us confidence that these approaches are safe and could be used for other global health priorities. So platforms are one way of doing this.

Another example is a company we’ve invested in that’s developing a Shingrix competitor. Their core platform is the design of a protein antigen, but also this novel adjuvant. The conventional adjuvant [in Shingrix] is in short supply because it requires a natural product input, but they’ve made it synthetically, and so it can now be applied to other vaccines or licensed to other providers. So that’s one way of thinking about it: what can this thing do besides what the flagship example of the product is?

Selling to pharmaceutical stockpiles (10:07)

Charlie Petty:

And then there are a couple of other options: global-health stockpiles and national-health stockpiles are ways to create markets where they wouldn’t otherwise exist—

Ross:

How big is the Total Addressable Market, in pharmaceutical stockpiles?

Charlie Petty:

It ranges widely, depending on what you mean.

The US strategic national stockpile, jointly managed between agencies, includes masks, respirators, antiviral [drugs], as well as tools for traditional kinetic warfare, or radiological, nuclear, or chemical attacks. It’s not totally public what goes into it, but it’s hundreds of millions per year in resupply, and a lot of that is planned purchases for pandemic influenza vaccines and replacement of outdated equipment, that kind of thing. It’s not a huge market—

| Fiscal Year | PHSSEF (supplies + drugs) |

Project BioShield (drugs) |

| 2014 | $ 549 million | $ 255 million |

| 2015 | $ 534 million | $ 225 million |

| 2016 | $ 569 million | $ 510 million |

| 2017 | $ 574 million | $ 509 million |

| 2018 | $ 604 million | $ 710 million |

| 2019 | $ 610 million | $ 735 million |

| 2020 | $ 705 million | $ 735 million |

| 2021 | $ 705 million | $ 770 million |

| 2022 | $ 845 million | $ 770 million |

| 2023 | $ 965 million | $ 820 million |

| 2024 request | $ 995 million | $ 830 million |

Annual totals excludes one-time emergency appropriations.

Ross:

—I mean, that’s niche compared to a single blockbuster drug hitting the commercial market.

Charlie Petty:

Correct. But for non-traditional biopharma companies developing a medical countermeasure, a small startup with a Phase II product [Ross: meaning, proof-of-concept trials in the target population] could get a purchase order for several hundred million dollars, which makes a big difference. Especially when these drugs don't require Phase III trials [Ross: meaning, large-scale, definitive efficacy trials]—for medical countermeasures without peacetime use cases, you just need to demonstrate safety. You can't do “challenge” trials [Ross: meaning, controlled-exposure trials] in humans with anthrax or Ebola, so for relatively little development cost, you can get a product that could be stockpiled.

There's also the UNICEF stockpile—UNICEF has, for example, a cholera vaccine stockpile—

Ross:

—though that’s for outbreaks, not national security? [Ross: In retrospect I regret this statement; outbreaks can of course present a threat to national security.]

Charlie Petty:

Yes, though outbreaks follow a similar paradigm where there’s not enough business for a cholera company. In fact, there’s only one left in the world—we invested in it in our first fund—because there’s a maybe $50-150 million market for cholera depending on the year, and that’s not enough to sustain a company.

But [the stockpile’s purchases] are signaling to the market that there’s this ongoing demand; it’s not quite a prize, not quite an advance market commitment, not quite a guarantee of supply, but something in the middle, because there’s a periodic refresh of the drawn-down stockpile. But this is not something that you can build large biotech companies around; you’re not going to build the next Genentech by selling to stockpiles, as the [Total Addressable Market] isn't big enough.

Priority Review Vouchers (12:59)

Ross:

Let's return to priority review vouchers—how does that program work? And how does it look from where you sit as an investor?

Charlie Petty:

It's a funky program not many people outside the industry know about—it came from a paper by David Ridley at Duke in the mid-2000s proposing a novel incentive mechanism. It allows developers of drugs for neglected tropical diseases, or some rare diseases, to get a shorter review period. [Ross: Look, I don’t love the term “tropical disease”, but it is the term most widely used in the field, in my experience.]

These are areas where there isn’t a lot of commercial funding available—

Ross:

—but it’s been decided that it’s a policy priority of some sort—

Charlie Petty:

Yeah, so there's a list, in the legislation, of neglected tropical diseases—some have been added over time, especially as the list has been whittled down—and if you develop a drug for this category, you get a shorter review on that drug—instead of 10 months, it becomes 4-6 months. [Ross: I’ve often heard this cited as a speedup from 12 months to 3 months, but obviously mileage will vary.]

[Ross: After we recorded this interview, the FDA announced a expansion of the Priority Review program with ‘Commissioner’s National Priority Vouchers’, “to give a limited number of vouchers to companies aligned with U.S. national priorities”. It is not clear at press time what priorities the FDA will pursue with these discretionarily-granted vouchers, but the biggest news is the executive branch asserting its authority to add voucher targets beyond those specified by Congress.

While I’m happy for Congress to make target lists, I’m cautiously optimistic that the Commissioner’s office will be able to specify additional priorities with positive impacts for the American people.]

And you might ask, “Why does that matter for a drug with no commercial value?” Because you also get a voucher you can use for another drug to get it reviewed faster. That voucher doesn’t matter so much if you’re a vaccine company and you want another vaccine to be reviewed faster—but if you sell it to a company like Novartis that's racing five or six other companies to blockbuster areas with drugs selling for billions—

Ross:

—in heart disease, or cancer, or, recently, in obesity—

Charlie Petty:

—then it’s basically just [Net Present Value] math, and it’s also first-to-the-market math. Getting six months of review time chopped off—

Ross:

— how much is that worth, for the biggest companies?

Charlie Petty:

The vouchers have traded in the $50-350 million range; at this point, the market has basically decided that $100 million is where these things trade. As an investor, that’s what I’ll think of as the notional value of a PRV in the market.

As an example, we invested in a PRV program for river blindness, a parasitic disease affecting very poor people in Central and West Africa with no commercial market. The current standard of care is ivermectin, and that’s just donated by Merck; there’s really no market. There are many diseases like this that matter a lot—soil-transmitted helminths and other nasty and horrible things that you don’t want children to get—where there’s just no commercial market.

So on the push side, groups like the Gates Foundation and Wellcome Trust fund early research and development. On the pull side, the PRV creates the potential for profit for those who successfully develop these drugs.

As you’ve talked about before, Ross, it’s critical to engage the entrepreneurial and biotech ecosystem to develop drugs. The vast majority of drugs ever developed and launched have been developed by companies, and this program allows companies to take on neglected diseases with the promise of potentially $100 million on the other side. It’s a pretty cool program.

Ross:

There are a few other policy priorities that have been added in, as it gets reauthorized and in appropriations—

Charlie Petty:

It’s kind of wonky how Congress approved these, but the original neglected tropical disease targets are the most enshrined. Later there was a provision for rare pediatric diseases, somewhat less enshrined. There was one for medical countermeasures and pandemic preparedness that sunset [in 2023] and is working its way through various reauthorization bills. [Ross: At press time, the rare pediatric disease program has also lapsed and is similarly awaiting reauthorization.]

There is a risk of being at the whim of Congress [Ross: Though if the FDA assumes the ability to grant new vouchers directly, that’s an alternative backstop!], but it’s interesting that it doesn’t require taxpayer dollars. In the political climate of the past ten years, frankly, finding a Pareto-optimal solution that gets something done without taxpayers having to pay for it is pretty cool.

[Ross: In fact, there is an additional $2.5 million fee for using a voucher, on top of the standard $3 million filing fee, which is calculated specifically to offset any increased costs of conducting priority review, as compared to standard review.]

The FDA views the program as really impactful, and are happy to do it—most people who work at the FDA are really mission-driven people who could be making more money elsewhere, and so we've had really positive interactions with regulators to get these programs done.

Making your own investment opportunities (18:06)

Ross:

When you’re impact-driven but you’re looking in the venture world for these things that make a commercial case as investments while also pointing in the same direction as your mission, can you just find $100 million of investible opportunities? Or do you have to make your own opportunities by shaping the market?

Charlie Petty:

All of the above. We’ve established ourselves as leaders in global public-health investing through various means. We talk to foundations funding early-stage programs, government agencies funding academia or nonprofits, and we network with VCs and pharma companies who are excited to work with us when they find deals they are excited about personally, but don’t know what to do with [commercially].

So when a vaccine comes across their desk, at one of these venture firms, we often get a call, which is what we want—to be the first port of call for VCs investing in infectious disease and public health. We've looked at bringing things out of pharma [companies] and supported others to do that—by basically creating an opportunity where a company is discharging its infectious disease program or winding down a vaccine program, and you them and say, what if I gave you $X million to buy it, and we split the economics if things work out.

But we have to be pretty scrappy; we’re not just sitting here, getting pitched by VCs and entrepreneurs all day. Though I think there are a surprising number of people pursuing really important public-health products in the form of companies—so it's a mix of inbound deals and hustling. We attend conferences where we’re often the only VCs there—though at the World Vaccine Congress this year, there were two other venture firms, which often isn’t the case.

Ross:

Nice!

Charlie Petty:

We go to events like the Developing Country Vaccine Manufacturing Network, which is really focused on production of vaccines in emerging markets—

Ross:

—and which really does sound like the venture event of the year.

Charlie Petty:

(laughs) Exactly.

In 2018, I was in Kunming, China with leaders from developing country vaccine manufacturers—most of these organizations were often public-private partnerships or government-owned entities that have been privatized or nationalized, depending on the politics. So you have these really fascinating people who have been working in these pharma-adjacent vaccine-manufacturing companies for years, who just know more than anyone about making large-scale, super-cheap vaccines. They’re often the partners we want for vaccines that we invest in—that are developed in Silicon Valley or Kendall Square—ultimately we want these vaccines to be made available globally, and so we’ll have our companies partner with one of these manufacturers to do it.

So we’re all over the place, and in a lot of places that traditional VCs don’t spend a lot of time.

Portfolio composition: New vs. old tech (21:10)

Ross:

How does your portfolio break down between shiny, new, cutting-edge tech versus low-scientific-risk applications of proven platforms into new areas?

Charlie Petty:

We probably see 50/50 but act more like 80/20 in the direction of “shiny new things”, with 20-30% in the “special situations” bucket. We're playing in an interesting space where there might be 1-5 fancy vaccine companies that launch each year with top-tier VC backing, and then there are dozens of poorly funded academic spinouts that have been around for a decade, often run by the PI, that have been surviving on grants.

We try to find the best ones of those and help with financing and talent, but there are just fewer of them that we view as investible. So something that we like doing is, finding a great team developing their own vaccine candidate and matching them with an interesting technology from academia by licensing that product into the competent management team’s portfolio. That’s a nice thing we’d like to do more of, but it just requires a heavy lift—it’s a lot harder than just saying yes to an investment.

Ross:

Sounds like pretty high-touch work.

Charlie Petty:

Yeah; we’re happy to roll up our sleeves and do that, but our portfolio has a bit of both [kinds of investment].

Evaluating counterfactual impact (23:00)

Ross:

Putting on an effective-altruist hat—when you’re investing, are you causing something to exist that wouldn’t otherwise, or are you just along for the ride and receiving profits that could have gone to some other investor? How much moral credit do you get as an investor?

Charlie Petty:

You wouldn’t believe how many conversations we’ve had about causality and counterfactual impact at the firm!

But there’s a wide range—in some cases, we piggyback on a project that was already going to happen, money is fungible, and someone else would’ve written that check [if we hadn’t]. In those cases, we like to think that our counterfactual impact is typically around access rather than about making the project happen.

Ross:

Can you say more about that?

Charlie Petty:

Yeah. Think about a vaccine company that’s being launched by a top-tier venture firm—we’ll come in and get on the board, but we’ll also have a side letter that we sign, with the company, that obligates the company to do certain things. Those things might be:

- create a development plan for emerging markets,

- register the product in specific countries within five years of commercial launch, or

- charge [Cost Of Goods Sold] plus 50% in those countries (Charlie: which is 99% less than you would charge in the US).

So our involvement can be counterfactually impactful—not in terms of whether something exists or not—but in terms of how fast it reaches the developing world. That's more relevant for our global-health investments focused on getting products out there as soon as possible—less so for the kind of cutting-edge technology where the product is 10-15 years away. There, it can be much harder to see into the future, about what is going to matter from an impact standpoint.

In that 20-30% special-situations bucket, we often feel very counterfactually impactful because we’re often picking up assets that are actually being wound down, shut down, or are just not being developed. There, we’re picking something up that’s been sitting on the ground for a while, and so for those we give ourselves quite a bit of credit.

In other cases—we’ve done medical devices, where we obligate companies to develop lower-cost or reusable versions, to port diagnostic tests to cheaper platforms, or to lower the cost by making other design changes. So it's investment-by-investment—sometimes we’re part of making something happen; other times we’re making something 20% better. But I’m very happy to make things 20% better as well.

Ross:

Sure. 20% of a big number is a big impact!

Charlie Petty:

Exactly. If you think about a vaccine that will reach hundreds of millions of people, one year sooner or cheaper, or just reaching more people—the numbers add up.

Working with company management (26:26)

Ross:

When you’re approaching a company like this—where you want them to have a global-access program for emerging markets, but from a commercial perspective, it’s not going to cost them anything or make them anything—how hard is it to convince company management to go ahead with that? Or are these things they wanted to do anyway and you're just providing direction and an excuse?

Charlie Petty:

It’s all over the place. Some companies want to do this already but need funding or an excuse to do it, and our involvement provides that. As fiduciaries, we can't simply ask companies to do non-commercial activities, so we’re often building the business case for emerging markets or neglected areas, or working with non-dilutive funders who can fund these programs.

So for a specific program that we really like within a larger company, where equity dollars just aren’t available, we might bring in foundation partners to fund that work—and maybe some of our equity dollars go towards it. That’s one version of it.

In special situations where we're the lender of last resort, we have more leverage to say: “You might make a lot of money from the PRV, but it’s important to us that this be accessible, so as part of the [funding] agreement, we want a very concrete plan for how you’re going to get it out there.”

Some investments, like pandemic influenza vaccines—where it’s inherently good to have them stockpiled out there in the world—we’re just very aligned with the company and we don't need to ask them for anything different.

Each case is bespoke, but in general—in life, but also in general—it’s very hard to get people to do things they don't want to do. So in basically no cases are we approaching a company that vehemently does not want to do this thing and just needs our money. If we have to create a Byzantine legal structure to force them to do something—as a career investor, I’ve never had anything work out like that. We focus on finding teams that are excited about this partnership.

“Most people are in this business to improve the world” (28:55)

Charlie Petty:

Oftentimes, we’re one of the smaller institutional checks—but we get substantial face time with company [management] and spend considerable time with them, maybe we get a board seat. That’s largely because—as I said earlier—most people are in this business to improve the world.

There are exceptions, but if you’re the CEO of a scrappy biotech company, you could be doing many different things—so most of the people we interact with are pretty great, and are doing this for noble reasons.

Ross:

But you’re one of the few capital providers who is actually speaking to that motivation of why the founders are there in the first place.

Charlie Petty:

Yeah, well, there are several reasons that could be. Part of our identity came from, just, willpower exerted 10-15 years ago, by the people at the Gates Foundation and JPMorgan who formed GHIC—mostly driven by big personalities like Bill [Gates]. Sometimes that’s what it takes to get things done in the world.

And another one is: we’ve chosen a strategy around what we think will actually work. I don’t think that this would work well—speaking empirically—in a domain where you don’t have a robust adjacent commercial engine, which in this case is pharmaceutical development. Elsewhere in healthcare, there have been a bunch of funds launched around digital health, MedTech, patient access, or physical infrastructure that have struggled; in our area, we benefit from this engine of intellectual property generation in the US and other biotech ecosystems.

Ross:

You mean the academic ecosystem, NIH, NSF funding—all of that’s feeding the “engine”—

Charlie Petty:

—it’s this endowment that we benefit from. It’s much harder to do things outside this superpowered research-and-development industrial complex we have here in the US.

Ross:

Whereas, a digital-health app won’t come already quarter-baked out of a university—

Charlie Petty:

—totally. I think we’re very lucky to have that.

More expensive and slower: “We’re in it with everyone else” (31:09)

Ross:

One conversation we keep returning to on Development & Research is: What is going on with the cost of developing new drugs and the timelines involved? Some of the trends here are looking pretty ugly over time. Is that showing up in your world, in public health?

Charlie Petty:

Yeah, we’re in it with everyone else. That said, we're privileged that regulators, generally, want more public-health products in the world. So while there may be some pushback against areas that are just marginal improvements that don't generate significant patient impact—you see this in oncology, you see it in the autoimmune space—

Ross:

—when companies create a new, on-patent drug at a much higher price than what was already generic?

Charlie Petty:

Exactly. My sense is that there is some general pushback around the deluge of drugs like this, especially when there's some goalpost-shifting on what we’re even trying to do here, on an indication-by-indication basis. We see huge conflicts in areas like Alzheimer's, DMD, and some of the gene therapy programs—and without getting too political, there are some people in the FDA who care a lot about certain modalities. Then there’s huge pressure from industry groups and patient groups, and that creates a complicated mess.

Ross:

But when something for river blindness crosses a reviewer’s desk, and—

Charlie Petty:

—and no one’s mad that we’re bringing river blindness treatments to the FDA. But I do think there are structural things: the agency—in my view—is under-resourced and could benefit from more technology and straight-up human capital, which is the limiting factor [throughout] drug development. In our portfolio, though, we definitely benefit from the agency caring about public health.

For our work, what matters isn't just FDA approval but also the CDC and ACIP—the groups that actually recommend how drugs are used. These exist in the US with parallel institutions abroad, like in the EU.

So there’s a lot you could say about the FDA, broadly, but in our investment area, we generally encounter a constructive regulator. Some people in other areas of drug development might not agree with that.

Ross:

So if costs are rising—but it's not from regulatory pushback—where's that coming from?

Charlie Petty:

Take vaccines, for example. There the bar for safety is—appropriately—very high, and it’s getting higher over time.

Ross:

The bar had been lower, and that’s why the costs are now higher than they were then?

Charlie Petty:

Drugs approved 30-50 years ago were just in a different paradigm—and some of those are vaccines that we’re still using today.

Ross:

But the polio vaccine—

Charlie Petty:

—would never be approved today. Or at least, not without a ridiculously different [Investigational New Drug application] package and [Biologics License Application] filing than they had.

Ross:

You mean, it would have gone through a lot more development to end up with something slightly different?

Charlie Petty:

Totally; there’s the safety element, which [now] requires bigger trials and more demonstrations of safety and efficacy.

Ross:

Could you put numbers on that? When you say “bigger trials”, how much of that larger trial is—realistically—for getting at the safety side, versus the efficacy side?

Charlie Petty:

That’s a great question, and it differs by modality. For vaccines—which are a product for healthy people—a totally novel vaccine might need 10,000+ patients. It depends on what the [antigen] construct is, but you need thousands of patients to show efficacy and you’ll need thousands to show safety.

A huge caveat here is that it really depends on what you’re trying to do. If you're just trying to show some biomarker that is equivalent to something we know is protective for a certain disease, the numbers can be lower. [Ross: …on efficacy.]

Ross:

You mean, if you can show that people are developing the right antibodies—

Charlie Petty:

If you can show the people are developing antibodies, you know that this antibody is protective—especially for fast-follower vaccines, where it’s the second or third, improved version of a vaccine.

But for field efficacy trials in a new vaccine—the Gardasil program (or the Shingrix program), they needed to go out and vaccinate tens of thousands of people and hope that the attack-rate math (Charlie: how many people in the control group and how many people in the active group have a chance to get the disease)—these numbers get really big at 1% to 5% recurrence rates for shingles, and the numbers are the numbers.

For some disease areas—like oncology—it’s very hard to find patients for other reasons, but it’s not because the numbers are big; it’s because you need to recruit this subsection of a slice of a slice of a slice of a patient population, send them to a top-tier cancer hospital, and pay $100,000 [per patient] to do the trial.

[Ross: Well, I would say that you decided that you needed to recruit a subsection of a slice of a slice of a slice of the patient population, and then the rest follows from that. If you were confident that your drug could go toe-to-toe with the incumbent, you could just go with a more-open inclusion criteria that made it significantly easier to find patients. Some of my favorite drug developers—I won’t name names, with some stories given in confidence—make this smaller-effect-for-easier-recruitment, and at least some of them do benefit from it.]

Whereas, in vaccines, we have to find 10,000 people to do this study—

Ross:

—and no one’s getting $100,000 of medical care—

Charlie Petty:

—and that makes the incentives weird, and you have to sign up dozens of clinical sites across the US, Europe, Asia… Well, there’s a whole conversation about where you do the trials.

In the US, you’re trying to go hospital to hospital, or clinician to clinician, and get them to sign up for your trial. Most large pharma companies and certain [Clinical Research Organizations] have vaccine trial networks, so some of this already exists, but it’s just not cheap to recruit thousands of Americans to get a shot.

Ross:

What does that cost? I want to get into the nitty-gritty.

Charlie Petty:

Okay, let’s get into the nitty-gritty. People throw out numbers for oncology trials in the range of $100,000+ per patient. We’re not in that zone, in our world. In the US, for vaccines, $5,000 to $20,000 seems possible—with tons of caveats about what the vaccine is—not including recruitment.

But that doesn't include manufacturing, which for something like a recombinant protein vaccine means growing proteins, harvesting, filtering, safety testing, adding an adjuvant, and vialing—that’s millions and millions of dollars even for Phase I, even for a twenty-patient trial. At that point, each incremental patient—from a [manufacturing] perspective—is trivial, and it’s the up-front cost that’s the problem.

Then there’s tons of caveats around how big the safety database is going to be—if you’re going to do a novel adjuvant, there’s a very high bar for safety and you might have to do a separate study of safety just for the adjuvant [before the vaccine’s own safety trial].

We do see efforts in global health to lower these costs—just doing trials outside the US saves a lot of money—but if you’re in a flagship US hospital, you’re talking thousands and thousands of dollars per patient.

“Burning tens of millions of dollars a year in overhead” (38:44)

Charlie Petty:

And then, a company that’s operating a Phase II trial is also burning tens of millions of dollars a year in overhead—

Ross:

—wait, where’s that money going?

Charlie Petty:

Well, it’s less than 100 people at the company, but you have a whole Regulatory Affairs team, you have a [drug manufacturing] team, you’ve started a clinical research team—

The basic model for a biotech these days is, you can be fairly outsourced and remote early on—using Clinical Research Organizations and also [Contract Development and Manufacturing Organizations] for your manufacturing—but as you go on, you do have to bring more of that in-house. If you’re developing a novel drug, you just have to have an internal team of people who understand how the drug is made. So then we’re talking about twenty PhDs in San Francisco or Boston, and that’s very expensive.

Then you need regulatory affairs, medical affairs, people just processing the data from a clinical trial even after you get it from the CRO—that’s a huge task; regulatory affairs is more art than science, and it requires the right person for that role; leadership, a CFO and other staff—it adds up quickly.

Ross:

So you’re burning tens of millions of dollars a year—

Charlie Petty:

—just on staff and offices. These are not extravagant operations, but it adds up.

So time is of the essence, because in biotech VC, you fund in a single tranche to a milestone, and then you fund again, and so you’re constantly in this race [to reach the next milestone before the money runs out]. Sometimes we want clinical trial costs to be lower, but sometimes we choose for them to be higher so that we can go faster—because there are other costs accruing that are not directly related to the trial, and that would sink the company before the trial would be completed.

You're constantly balancing quality, size, speed, and investor appetite. If you were to come to me and say “we found a way to make a vaccine trial where patients are going to cost $1,000—it’s going to take 15 years to recruit them, but you’re going to save 90% on clinical trial recruitment”, that just doesn’t work.

Speed matters a ton, especially when you’re entering a market with three or four competing products plus or minus a year from you—as is often the case. How much is six months worth? In blockbuster pharma, we know from the PRVs, about $100 million. It's an interesting math problem, and one that we think about every day.

Ross:

That’s fun; we don’t always think about—we can pay a lot of money to go faster, and sometimes that’s the right lever to pull. I guess controlling costs isn't the only thing that matters for impact.

[Ross: In point of fact, I often drag Pfizer's Paxlovid trial for costing more than ten times an equally-sized Latin American trial that was running at the same time (which I was involved in funding). I said this at an unconference, and someone pointed out that if they could have paid triple what they did and gone just one month faster, it would have been cheap at the price.]

Charlie Petty:

Exactly. In a pandemic, speed matters more than cost by a lot. In competitive markets like GLP drugs, speed matters more than cost.

But then, for neglected tropical diseases, cost matters more than speed—speed matters, but it's a direct trade-off. If you have single-digit millions of dollars for a Phase I, you really need to be scrupulous about how much that costs.

Can trials cost less? (42:06)

Ross:

Okay, so there’s this whole frontier of different options, different strategic choices here. But just to set levels, in public-health interventions that you’re looking at—vaccines and non-vaccine countermeasures—what do those costs look like?

Charlie Petty:

It ranges by literally an order of magnitude—

Ross:

—only one?

Charlie Petty:

Only one. I think. (thinks) It could be two.

Vaccines and therapeutics are just different worlds—healthy people versus sick people, and you can find the sick people easier. But in vaccines, where I spend a lot of my time, just getting to an IND [Ross: “Investigational New Drug”, meaning, approval to give a new drug to humans for the first time] typically costs $10-30 million. Now, that’s a generalization—some of these large platform companies have spent hundreds of millions of dollars without an IND yet—but when I think about a typical, tactical, single-asset company focused on an RSV vaccine, that’s what it costs to get to IND.

That [$10-30] million is some [manufacturing], animal trials, overhead, a bunch of assays characterizing the product, and [Good Manufacturing Practices-certified] manufacturing in advance of going into humans, meaning manufacturing processes that are well-controlled and safe. [Ross: …and, crucially, where every step has been logged, recorded, and performed exactly according to the specified manufacturing protocol.] Especially in biologics like vaccines or antibodies, that’s a whole world.

Then, to run a Phase I trial—which ranges in size from tens to hundreds of patients, but oftentimes will be in the 10-50 range—where you’re just demonstrating safety [Ross: in a small sample of "healthy normals"].

Phase II can range even more widely, especially depending on what you're trying to demonstrate. Oftentimes, you can demonstrate efficacy in a Phase II, because now you’re allowed to include patients who have the condition you’re treating. In other cases, you can measure a correlate of protection when you’re chasing a product that already exists on the market and just trying to create a better one. In those cases, you might design a larger trial in order to demonstrate statistically that you’re equivalent to this other, already-approved product, paying up-front for a larger Phase II trial for those reasons. Or if it’s a novel product with novel components that the agency is worried about, you may have to be larger to provide more data about safety. But a Phase II with any of these goals might be in the $50-150 million range.

In the neglected tropical disease, small-molecule world, the cost of your second trial might be an order of magnitude lower, or maybe up to $20 million.

Ross:

What’s changing to create that step down in costs?

Charlie Petty:

Number of patients and [manufacturing]. So if you're looking at the Phase II for a very high-end, potential-blockbuster vaccine at a big pharma company, the company is going to spend a lot of money in order to have more patients in more arms of the trial. [Ross: These arms might be testing different doses, or one shot instead of two shots, or letting you split by age or sex or some other condition that you have reason to think might matter.]

If you’re a scrappy nonprofit developing a drug for a [neglected tropical disease], you’ll do it with as few patients as possible, try as few different doses as possible, and generally have as little complexity as you can.

Now, I’m saying all these numbers in the context of the developed world—they’ll be very different in developing countries—

Ross:

—just from the cost of delivering healthcare?

Charlie Petty:

From the costs of doing anything—patient recruitment, delivering care, the placebo, or the intervention. So it feels almost silly to say these numbers, but we really have been involved with trials on both ends of these ranges.

I mean, a $5 million or $10 million Phase II trial would be a really cheap Phase II—and if you’re running multiple small trials, then the whole Phase II program might be in the [low] tens of millions of dollars.

Ross:

That’s if you’re using exploratory trials to narrow in on the version you want to use for your final shot.

Charlie Petty:

Yeah, so depending on what disease area, modality, or approach we’re talking about, you might be narrowing in on the dose, or narrowing in on the patient population—“hey, it didn’t work so well in this sub-population, so we’re going to take just the other group to Phase III”. There are a bunch of things that you could be tweaking at this stage, as you define your target product profile, dosing, and so on.

When you get to Phase III, what you’re bringing forward is a product you want to sell, studied in the population you want to sell it to. These need to be very large because you need them to show safety and efficacy [of that exact product, in that exact population].

[Ross: And with a bit more nuance, you might be required to show efficacy on a “harder” endpoint than you would have used at earlier stages. To take an example from oncology: you might measure the success of your drug by how much it shrinks the tumor when you’re using the results to plan your own next steps, but if you want to get the drug approved, the FDA is going to require you to show an effect on the five-year survival rate.

That’s a “harder” endpoint in that reflects “how a patient feels, functions, or survives”, and it’s going to be harder to hack your way to a misleading success, but it’s also going to take a lot longer to measure and almost certainly going to require larger sample sizes to (1) identify changes in infrequent events and (2) overcome the substantial extra noise introduced by a longer study window.]

In the rare-disease world, you can have a Phase III trial with 1 person in it; in the vaccine world, you can have a Phase III trial with 15,000 people in it. And in the 15,000-patient bucket, you’re talking about up to hundreds of millions of dollars for a single trial.

So it ranges widely, but the canonical reference point for how much it costs to bring a drug to market is in the range of a billion dollars, though sometimes the math is fuzzy about whether that includes pipeline failures, or just the direct costs of a successful candidate. But I think it’s not incorrect to say that it costs hundreds of millions to billions of dollars to develop a drug.

[Ross: Eric Minikel of the Broad Institute does the math for his take on an ultra-rare disease with a 50-patient Phase III, including the costs of pipeline failures and gets $600 billion of costs (in 2025 dollars) in terms of present dollars at approval. For something in the rare-to-uncommon range, I’m more used to seeing figures in the high $X00 million in direct costs and including-failures costs in the $1 billion to $3 billion range.]

So these are expensive programs, regardless of how you cut them, and that is the main thing that determines investment interest in the space—potential return relative to the costs and risks of bringing a program forward.

Clinical trials outside the US (48:02)

Ross:

But you do see public-health drug-development programs that might cost tens of millions of dollars rather than a billion?

Charlie Petty:

Totally. The billion-dollar figure refers to a blockbuster program for US and European populations, but for public-health drugs or vaccines, trials are often run in emerging markets where the cost per patient can be an order of magnitude lower. You’re often in areas where the disease you’re targeting is endemic—making it easier to find patients—or where attack rates of disease are higher, or where the population is untreated, vaccine-naïve, or the existing standard of care is just lower.

There's an interesting question—in biopharma in general—whether more trials should be done outside the US, but for global health products, a lot is done internationally because you have to.

But there’s other interesting things you can do to save money—Australia has an amazing R&D tax credit program—you basically get a 40% credit from the government for doing research and development there—so many of our companies have subsidiaries there, and Australia now has this amazing R&D ecosystem for public health.

There are so many levers to pull on to reduce costs—on the manufacturing side, on the clinical trial side—and we’re often talking to our companies about just these things: How can we save money and make the cost of capital low enough to attract capital from other investors to bring the projects forward?

Ross:

And is moving programs outside the US one of the first tools you reach for?

Charlie Petty:

Yes—though you can only do that in a limited set of indications and programs, right?

Ross:

Sorry, why?

Charlie Petty:

Well, it depends also on the phenotype of the company. If we're investing in a company developing an STI vaccine for US markets backed by top VCs in the US, they just are not going to take our notes about making this trial less expensive in the developing world (unless they already thought that it fits their strategy).

Ross:

The management team? The investors?

Charlie Petty:

Kind of both. Uncertainty and risk is the deathknell for investment in general, and so adding in even a vague, unspecified risks about things like “Can we trust the data? How does the FDA view ex-US data?”—that alone is enough to kill interest in moving a program outside the US.

Ross:

Just the risk of being weird?

Charlie Petty:

Yeah, just the weirdness factor—no one ever got fired for hiring McKinsey or IBM, and no one ever got fired for hiring a tier-one CDMO and CRO—

Ross:

—to do their trial in Boston.

Charlie Petty:

I mean, to be fair, if you’re spending hundreds of millions of dollars of institutional LP capital or big-pharma capital, I mean, they’re okay with making these choices.

Ross:

And on some level, if you’re spending tens of millions of dollars a year in salary comp and you propose cutting your trial cost from $100 million to cost less than your salaries by doing something that’s weird—that often doesn’t fly in the boardroom.

Charlie Petty:

There's also—I think the pharma industry is unfairly maligned in many ways, but there is a real dynamic where—if a company runs a gene therapy trial in an emerging market but has no plans to make that product available in that country, that's politically unpalatable. And so the company has to wrestle with that—

Ross:

—and how they take on an obligation to make the product available, if they go down that route.

Charlie Petty:

I mean, my preference would be—and there are companies that do this—that if you’re doing trials in emerging markets, you should plan to make products available in those markets and communities that you trialed the drug in.

Ross:

That does seem like the wholesome thing to do, but if the counterfactual is to not go there at all—it’s not clear that anyone is better off for that! Even if you just bring the trial and don’t bring the medicine afterwards, you have brought jobs, you have brought economic development, you have brought industry to that country and to that community.

[Ross: Look, I understand why people feel this way—that once you interact with a system, now you’re responsible for what happens (or doesn’t happen) next. But, like, if the rule you follow brings you to that, then of what use is that rule?

If you want to see more (A) but you criticize (A and not B) more than you criticize (not A and not B), you’ll get less (A) and I’d say the blood from that delta is mostly on your hands as a critic.

To make it explicit, here (A) is “the economic benefits to the local community of running a trial there” and (B) is “access to the drug after it’s approved”. In practice (A and not B) is more sharply criticized than (not A and not B) and as a direct result we tend to have less (A) in the world, and I believe it’s a worse world for it.]

But pragmatically, [in our society,] I guess that getting involved means getting entangled, and then that means that you feel like you have the obligation—and it’s easier to not even start.

Charlie Petty:

Really, I think they're just very risk-averse.

Clinical trials and drug development are risky to begin with, with low probability of technical success—if you start out with a likelihood that you get a drug from IND to approval of 20%, and that is impacted by even 1 percentage point, that's a 5% delta impairing the absolute percentage, which the models say doesn't make sense. Plus there's the intangible fear of the new—

Ross:

—even in cases where you might think people are afraid of the regulator, but the regulator in fact is welcoming these things. There are things that the FDA asks companies to do that keep not happening…

Charlie Petty:

Well, there’s the diffuse “ask”, versus the incentive for companies to respond, and then the question of who’s actually responsible… Who is “industry”? Does an individual CEO or an individual Head of Oncology have the ability to respond to the FDA’s desires in a coordinated way?

There are a bunch of questions in that direction, but—it’s interesting. So much of what we do is by its very nature in emerging markets, because we have to run the trials in these markets, and so it’s not something that we end up going to the mat on very often. Either it’s going to be run in the US, because that’s the way it has always been done and it was the plan before we got involved, or it’s a special situation where it’s going to be run in some emerging market because that’s where the disease is.

The rise of Chinese biopharma (54:13)

Ross:

Maybe this is now getting outside of your bailiwick, but are we seeing a trend of a move towards ex-US trials on the purely commercial side? Outside of cases where it’s forced by the nature of the indication, are we seeing more elective ex-US trials, especially after 2020?

Charlie Petty:

After 2020, probably yes—just because of global COVID trials—but it’ll be interesting to see what that returns to.

It also depends what we mean by “global”—if we include China and India, then definitely yes. China’s biotech sector is booming—

Ross:

—with plenty of trials running in China of drugs that were developed in China, and never touched the US.

Charlie Petty:

Someone ran a remarkable story looking at in-licensing deals in the US—in 2023-2024, 30% of those deals came from Chinese companies. That’s remarkable, and it’s up from essentially 0% a decade ago.

When I got started in this business, the CFDA was basically non-functional, and China was seen as a market to launch products into, not a source of innovation. But this is the expected curve of a country developing a robust research and development ecosystem and that has emphasized this as a priority, from the top.

Ross:

Even then, though, it was a manufacturing center—

Charlie Petty:

—and it remains a huge manufacturing center for pharmaceuticals. But oftentimes you see this progression, from just doing contract manufacturing to shifting quite quickly into actually building the higher-value products.

You can see that happen across a number of industries—China has had this happen where they were very good at making things cheaply and well, and now have a world-class research establishment. They have a real biopharmaceutical establishment that is generating real discoveries in a variety of disease areas and licensing them to the US, and that would have been unthinkable ten years ago.

That's exciting from a public-health standpoint—

Ross:

—and why’s that?

Charlie Petty:

I mean, I am just excited to have a non-unipolar biotech world—Europe has been an important part of the biopharmaceutical research and development complex for drug development and commercialization, but in terms of launching products into the world for the last 20 years, the US has been completely dominant.

If I’m thinking about this as a public-health person, I like having more minds and dollars going toward drug development, and it’s clear that China has a remarkable university and industrial biotech sector. There’s a lot of political overlay here about what that means for the US in terms of China tech versus US tech in general, but as a patient and as a public-health person, it’s hard to imagine more R&D dollars and more innovations not being net good—even if we have to bring them in and deploy them ourselves to have them domestically.

It would be hard for me to get upset about new vaccines being developed in a new country that hadn’t previously been developing them themselves, just as a patient and as someone who wants fewer kids to die.

Elsewhere in Asia, Korea and Japan have often punched above their weight—their GDP, or the size of their populations—in terms of international aid and R&D into public health, and it’s great to see another country getting into that.

Ex-US / ex-China drug development (57:41)

Ross:

So, if you bracket out China and say, ex-US / ex-China—then what’s happening in places where people weren’t previously doing research? Are the multinational pharma companies thinking about taking trials to Sub-Saharan Africa, Latin America, and Southeast Asia?

Charlie Petty:

One of the reasons it’s expensive to recruit patients in the US for oncology trials is the “sub-slice of a market” concept we discussed earlier. And that’s happening because, in order to enter the market with an oncology drug, you typically start with a type of cancer that is completely unaddressed—though by now there are a vanishingly few cancers that have no first-line treatment—or you’re aiming to be approved as a fifth- or sixth-line therapy for a sub-segment of the population who is currently unaddressed, and then keep moving upwards until you become a first-line therapy for that cancer subtype.

That means very long development timelines, difficulty marketing a product in its early years, difficulty even recruiting patients for your trials. But in emerging markets and some middle-income countries, you have treatment-naïve populations, and for that kind of thing you do have an opportunity where you can bring an experimental drug to people who wouldn't otherwise receive any care at all.

Bonus: Delivering cancer care in lower-income settings

(follows previous)

Charlie Petty:

I do see some of that happening—

Ross:

—because these aren’t places where you couldn’t deliver a chemotherapy plus a surgical intervention? There are many low- and middle-income countries where cancer gets treated in hospitals, and it’s not like the standard of care is so far behind—

Charlie Petty:

—with caveats, right? If you’re developing a new chemotherapy or a new PD-1 inhibitor, that’s possible, because it’s just an IV infusion. It gets complicated when you’re talking about genetic medicines like CAR-T—and it’s going to be interesting to see how that plays out—but for therapies following in the footsteps of Keytruda [Ross: an antibody drug that we discussed last episode], it’s definitely a benefit to be able to do your trials in treatment-naïve populations.

Now, that’s not an area that we cover—

Ross:

—even outside of the global centers of excellence on the cutting edge, because you don’t need to be doing your trials there.

Charlie Petty:

Yeah. There are some great organizations doing this; there’s a group at Stanford called GO, because—there is actually an amount of infrastructure that’s required; it’s not just setting someone up with an IV. The actual diagnosis and subtyping of cancers requires significant lab infrastructure, and it’s actually a significant health-systems change from treating cancer with these thirty-year-old chemotherapy drugs to immuno-oncology drugs—

Ross:

—meaning, personalized medicine?

Charlie Petty:

Even just being able to sub-type patients to determine whether you’re going to be a responder to this, and monitoring that…it’s actually pretty complicated.

I only know this, by the way, because I have friends who work in the global oncology space—but it’s clear that the health systems, doctor training, and changing of protocols is nontrivial. But I see some of that happening.

In our world [of infectious disease], though, we're used to working in these countries out of necessity. In some cases—for HIV in South Africa—these actually are the centers of excellence. If you’re running HIV clinical trials in South Africa, that’s as good as it gets. India is world-class in vaccine manufacturing…

Ross:

There are technological spillovers, right? Sub-Saharan Africa has relatively robust genomic sequencing infrastructure from working with retrovirals, which is an asset for applications in oncology, where—as you point out—you need to be sequencing cancer genotypes…

Charlie Petty:

You say it’s ubiquitous, but that’s only within hospitals—so many people live nowhere close to a medical center, so there’s that problem—

Ross:

—I mean, at the medical centers.

Charlie Petty:

At the medical centers—yeah, there’s a bunch of examples like this. There’s this kind of PCR test that’s used for tuberculosis, and now all these hospitals have this box that can be used for other diagnostics. Medical training is this intangible asset that you get when you’re dealing with any of these—and equipment is a tangible asset that works the same way.

Then with Covid, you had this infusion of capital into diagnostics—

Ross:

—and interest, and political will—

Charlie Petty:

—and then on the manufacturing side, billions of dollars went into mRNA manufacturing hubs across Africa with the idea that they would produce medicines licensed from Western or Eastern partners—

Ross:

—but with some continental sovereignty.

Charlie Petty:

Yeah. It’s pretty cool.

As we saw in the pandemic, things can get a little crazy, people get a little nationalist—

Ross:

—putting on their own oxygen masks first—

Charlie Petty:

—and, well, that’s been an interesting thing to follow.

Who should regulate drugs for the world? (1:01:09)

Ross:

As the landscape of global disease becomes one game board, all of these drugs still go through FDA as the main regulatory checkpoint. Does the FDA adequately evaluate medications whose use case and primary medical context might be elsewhere—where a treatment might make sense in those markets even if it falls behind the standard that’s widely available in the US? Can the FDA make reasonable decisions about medicines for Africa and Latin America?

Charlie Petty:

That's a great question. Practically speaking, when you go to the FDA, you're asking for US approval for the US population. They're answering whether it's appropriate for that population, they’re not really taking into account [the context in other countries]—

Ross:

—which isn’t their remit.

Charlie Petty:

Right. So, for something that is well-addressed here in the US, the bar for a new treatment in that space is going to be—understandably—very high.

Ross:

We saw this with Covid, when repurposed generic drugs came up for emergency use evaluation at the FDA. The FDA said—probably correctly—that “these don’t meet the standard of Paxlovid and other specialty drugs, and we can’t approve them, even on an emergency basis, for that reason.”

That’s notwithstanding that a large portion of the other 96% of the world didn’t have access to those first-line drugs drugs from Pfizer and the other companies—but in the end, no regulator got to an answer about whether these repurposed things were correct [for those more limited settings], because all those regulators were used to deferring to the FDA.

Charlie Petty:

The FDA was asked the question “is this an improvement over the standard of care?”, and they had the right answer for that narrow question.

We don't have a global regulatory authority with this mandate. There’s this process called WHO Prequalification, which exists to take FDA, EMA, or CFDA approvals and apply them elsewhere, but there's no top-tier regulator with a global view. They might consider it, but it's not their remit.

This creates huge problems for access during pandemics when there are drugs that would be helpful but aren’t better than antibody treatments or Paxlovid, and they can't get approved. I haven’t heard a really robust proposal for solving this, either spinning up a unit within the FDA or having a new, independent regulator for the world—

Ross:

There are discussions about this from the African Union and Africa CDC—there’s a sense that current systems aren't working well and perhaps they can be a political body large enough to address this, to represent these 1.3 billion people. We’ll see how that goes.

Charlie Petty:

I think it’s a cool idea. The CFDA [Ross: that’s the China FDA] is a good example of a previously non-global regulator that has become well-respected. There have been efforts around regulatory harmonization in Africa that I've had a little bit of experience with. Even if you get FDA or EMA approval for a drug or device—we talked about WHO PreQ— some countries recognize versions of that for approval internally, but oftentimes you have to go country by country. Several countries came together and formed the East African Regulatory Harmonization Regime, where countries recognize and respect each other's internal approvals with lighter reviews.

But we still don't have global—or even regional approval—systems. Most countries have to do their own evaluations, often using FDA/EMA dossiers as starting points, but it's not trivial—it’s still thousands of pages requiring expert review. Fixing this is a really cool idea.

The future of global public health (1:05:30)

Ross:

So to wrap up, what's next for you and what’s next for global health?

Charlie Petty:

I'm busy at GHIC finding opportunities in global health and health security—so if anyone listening is working in this space, I’d love to hear about it.

Ross:

Are we in a brave new world [for infectious disease] after 2020? What’s changed?

Charlie Petty:

There was some irrational exuberance in 2020-21 around vaccines, with many companies entering the space, I thought it was a remarkable response from the public-health and technology communities. I'm very proud to have seen that and been a part of that. In plenty of weird tail risk scenarios, I want people to be irrational. Since then, though, we have seen a reversion to below pre-pandemic investment levels as companies got burned. [Ross: See also my discussion with Brian Finrow about boom-bust cycles and the post-covid cycle in biotech.]

[Ross: There may have been an exuberance around vaccines, but I frankly think that the level of investment in treatments worldwide was wildly inadequate by comparison. I've seen estimates that collective investment in therapeutics was in the range of 5% that of investment in vaccines, and while I won’t necessarily claim we should have spent less on vaccines, I feel pretty sure that that wasn’t the right ratio.

Vaccines feel great—like getting a perfect score on the test—when they work, but we know that there are viruses where past exposure doesn’t produce immunity, or where viral evolution blunts the impact of the immune memory from a one-and-done vaccine. A virologist friend of mine is fond of saying that “just relying on a vaccine is like going to war with just a navy”—maybe you need one in order to win, but that doesn’t mean it's sufficient to win.]

I'm optimistic for several reasons—I’m feeling very cautious about what role the federal government will play in research and development going forward, but for the time being, I think it’s safe to say that the private sector and foundations will continue this work on their own.

Maybe this leads to a less unipolar global health R&D world—whether it’s China or the European Union, with more distributed models bringing in stakeholders not traditionally represented.

AI is an orthogonal factor not really thought about more than 2-3 years ago that's interesting in a lot of ways that could significantly lower drug discovery costs. Not just with predictive modeling, but potentially synthetic assays, modeling animals and organs in AI systems to reduce pre-clinical and even clinical development costs. These are just tools that have somewhat already existed in “AI 1.0”—leaving aside the idea of automated research agents or AGI—But even these tools that have already existed for a while in some forms are now actually being used, which is cool. People have been talking to us about AI clinical trial recruitment, AI drug discovery, AI modeling of organs, and organoids systems—these things becoming impactful enough to actually matter to the GDP of the biopharma sector is something I’m expecting to happen within the next 5 years, based on the papers I'm reading.

This could play into the idea of federated science, since the marginal costs of delivering models or technologies is so low compared to the upfront costs of developing [the AI tools]. If we’re talking about a distributed R&D ecosystem whether for funding or execution, having software tools—rather than wet labs and manufacturing—as the bottleneck is an interesting paradigm shift. I’m excited about that.

What we do—and what you’re interested in, on the podcast—has never been more important; pandemics remain scary with the H5 [influenza] situation, infectious disease isn't going away any time soon, and chronic disease is getting worse. There’s so much to do in this space, and it’s a really exciting time to be in the public-health R&D world. So we’re very busy!

Ross:

Charlie Petty, thank you very much.

Charlie Petty:

Thanks for having me.